Beautiful Work Tips About Petty Cash Expense Sheet

This is a powerful yet intuitive spreadsheet template that makes it easy to record, track, and review petty cash expenditures.

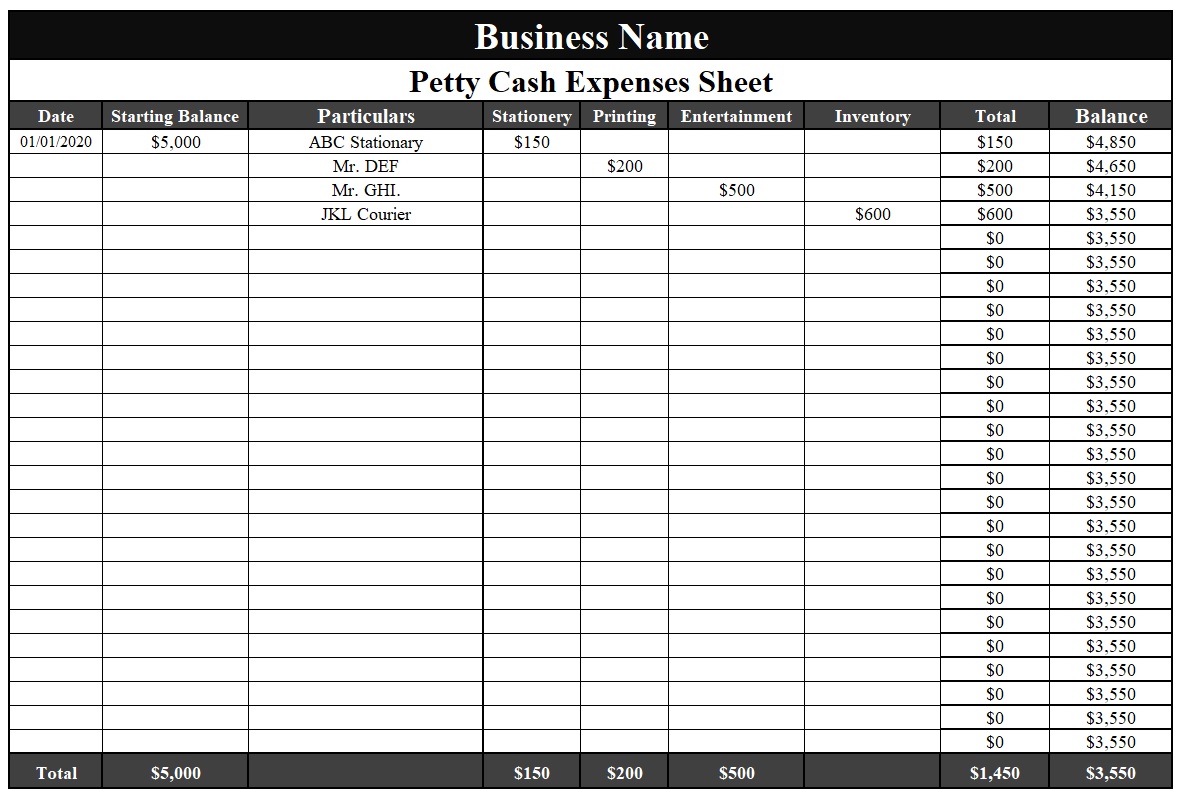

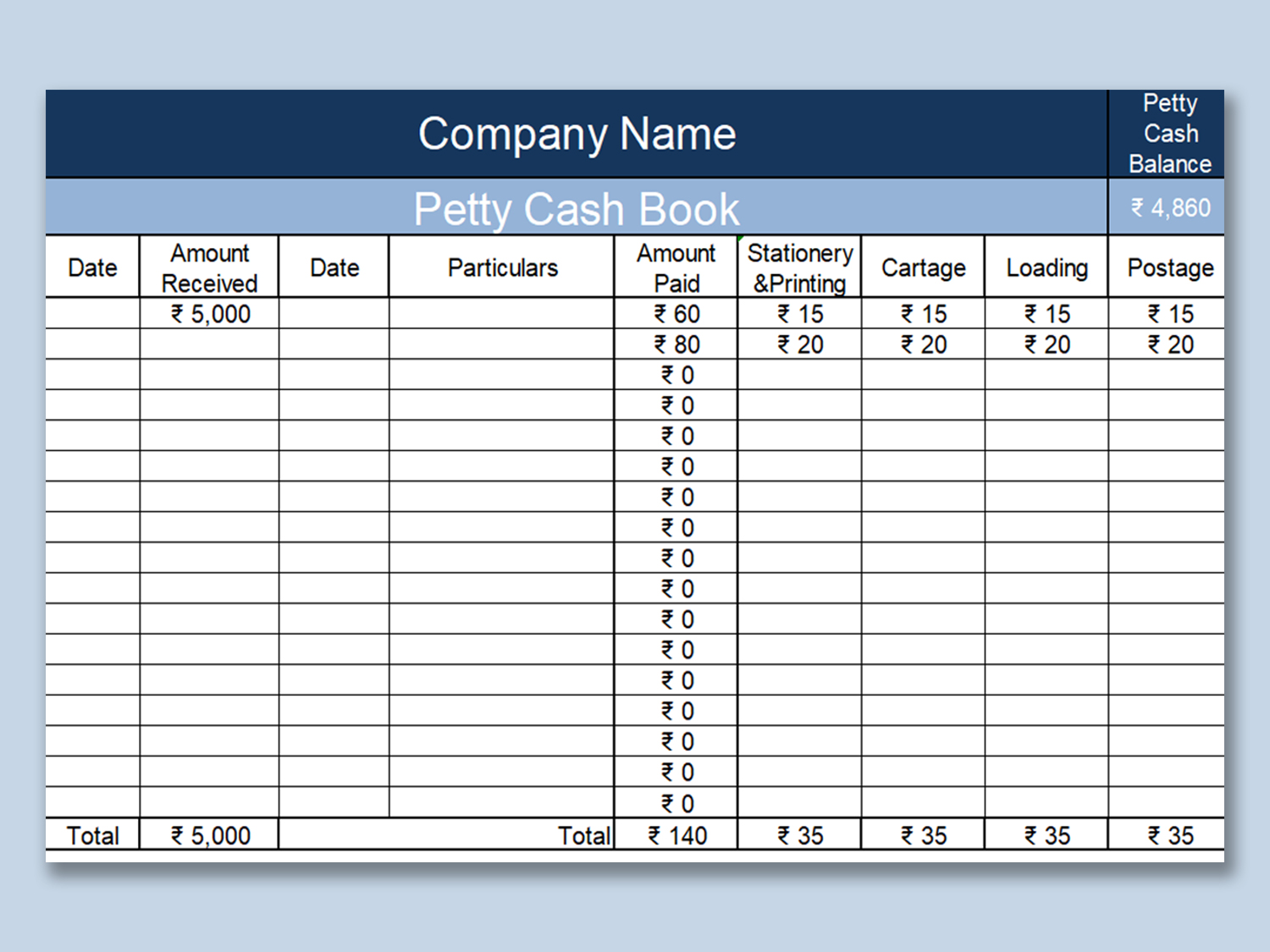

Petty cash expense sheet. Petty cash is cash that businesses keep on hand for small purchases. In the received column, we’ll insert the initial amount the petty cashier will get to expend on small expenses. A business uses a petty cash account for tracking physical cash used to make small payments.

While it may not be a whole lot of money, you still want to record and account for it. The group is about the payment type, which are postage, cartage, and miscellaneous. The pdf will be free of watermarks.

How to create common size balance sheet in excel step 3: Purchase a petty cash box read my article on 10 things to consider when buying a cash box. A petty cash fund is often used to cover small or unexpected expenses in an office.

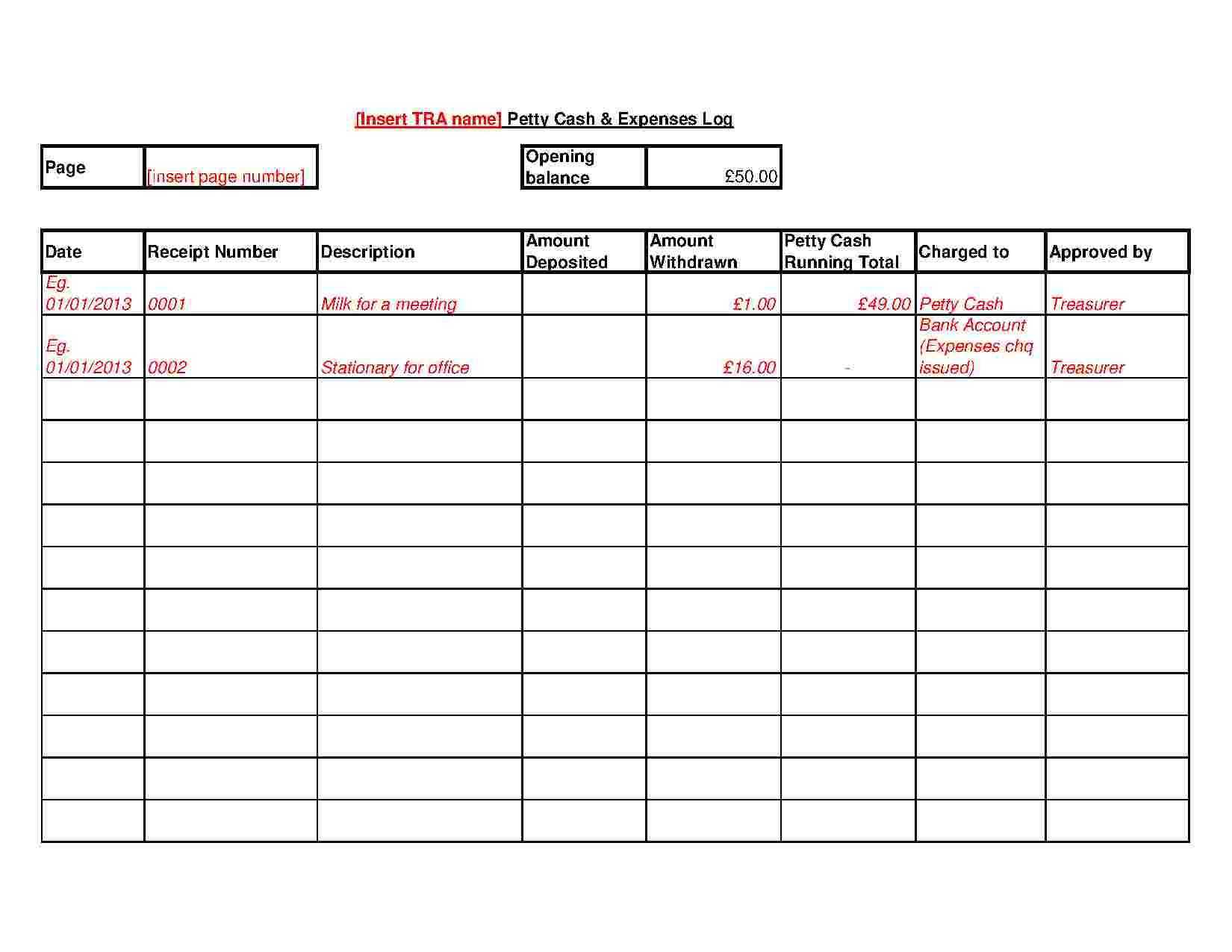

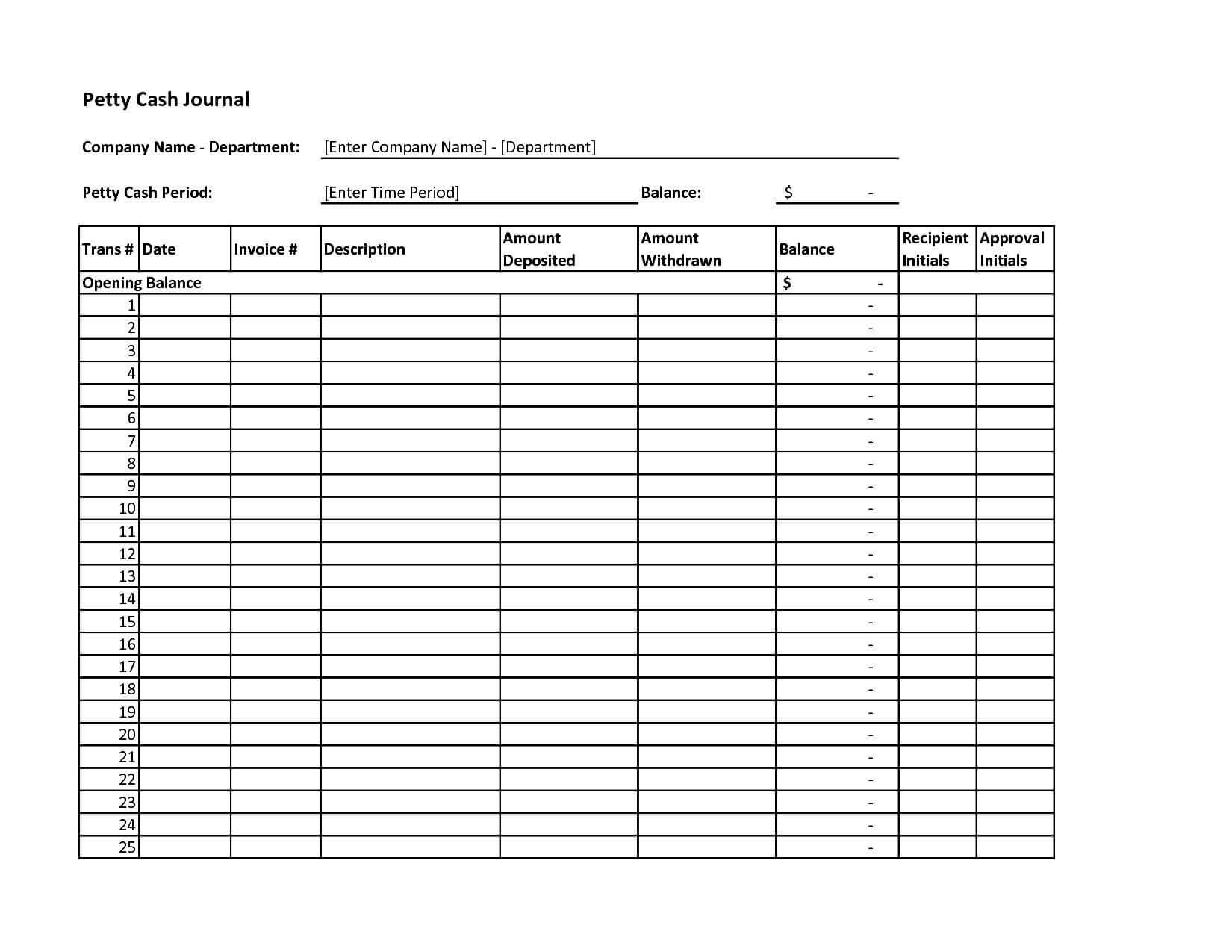

This expense report is a simple spreadsheet template for documenting the date, type, and total amount for each expense. The petty cash journal is simply a record of debit, credit, use of funds, and reconciliation processes. Postage for letters and packages.

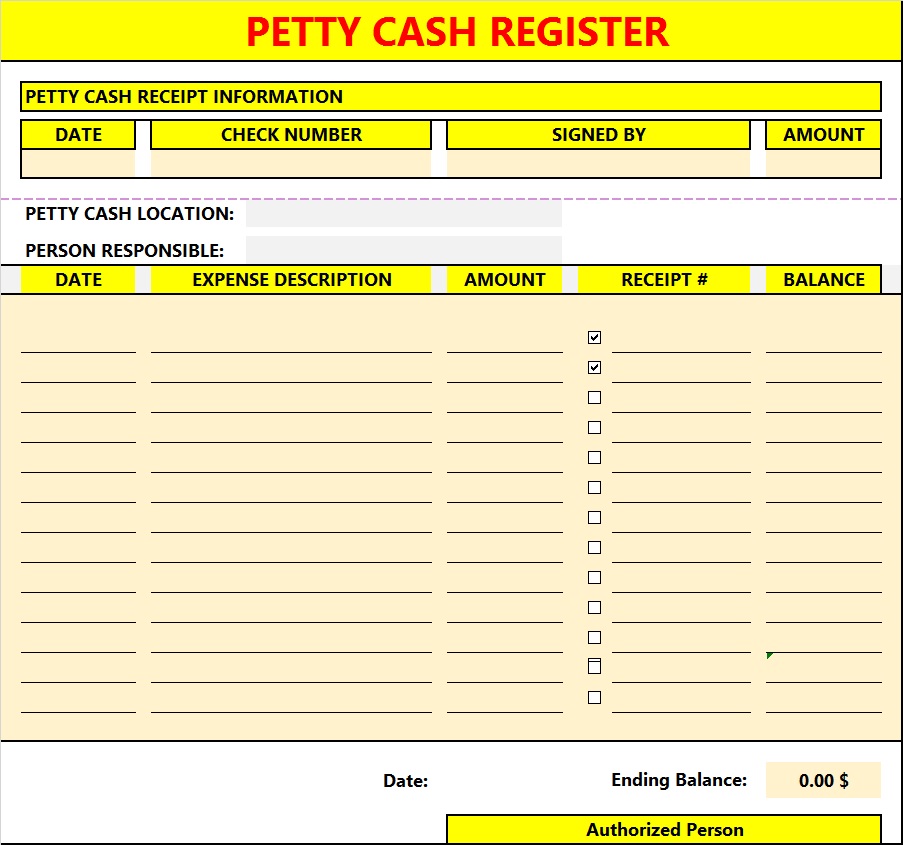

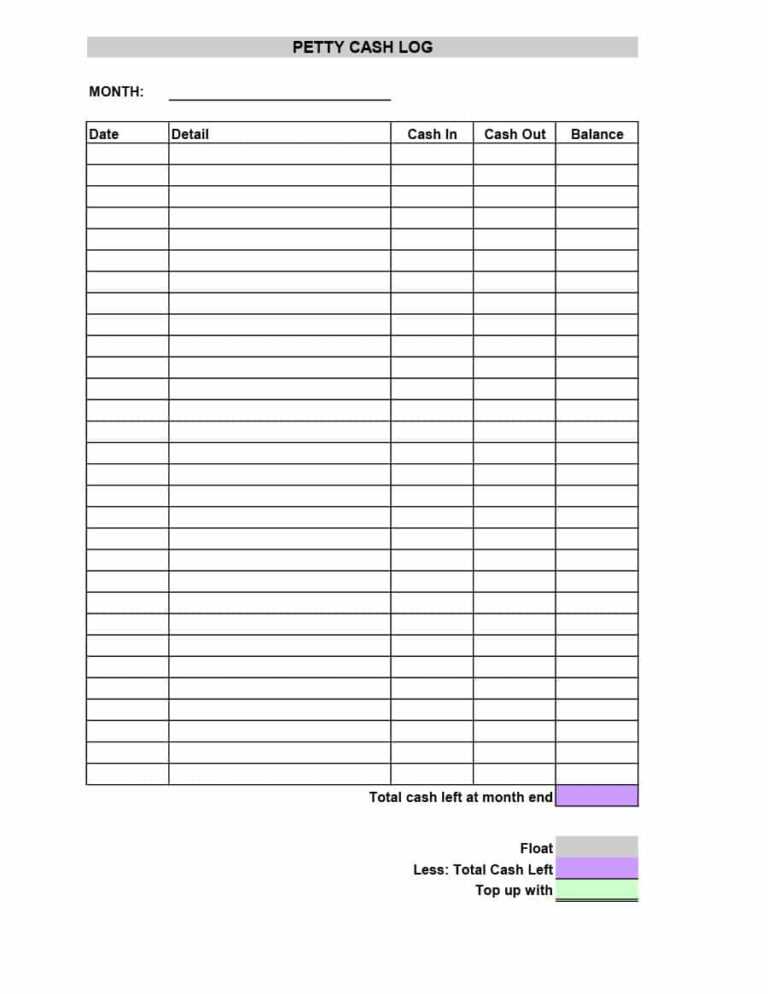

Add summary row then, add a summary row showing the cashier’s name, beginning, and current balances for a quick overview. Easily monitor your cash transactions and keep a record of all your expenses. The first thing you do is mention a title to your log sheet and in this context, it will generally be a petty cash log.

Create a header first, create a header for the balance sheet along with the company logo as shown below. Most businesses that aren’t large enough to issue company credit cards use cash to pay for all the little things they need at the workplace. The petty cashbook is a book that keeps records of quick payments for miscellaneous small expenses in the business concern.

Then, we have a date and group. Timesheet templates a petty cash log is used to keep the record of cash deposited, cash withdrawals, and the purpose of removing cash with the current date. Cash can be kept in a safe or petty cash box.

Rather than going through the regular expense reimbursement process, employees can directly access the petty cash fund to make small purchases or cover incidental expenses. A petty cash fund is a small amount of company cash, often kept on hand (e.g., in a locked drawer or box), to pay for minor or incidental expenses, such as office supplies or employee. Keeping a petty cashbook is a very smart practice for a business.

The cash can be kept in a small safe or locked file cabinet, perhaps in an manila envelope. Choose the size appropriate for you and one that has a lock and keys. One page, size 8.5” x 11”.

The use of petty cash can be an effective way to keep minor items from bogging down the accounts payable system. A petty cash log book lets you keep track of all the small expenses made at your office. Petty cash is a small amount of cash that is kept on the company premises to pay for minor cash needs.

![40 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-06.jpg?w=395)