Ideal Info About Net Present Value Calculator Excel Template

Be sure to browse our library of free excel templates for more useful excel.

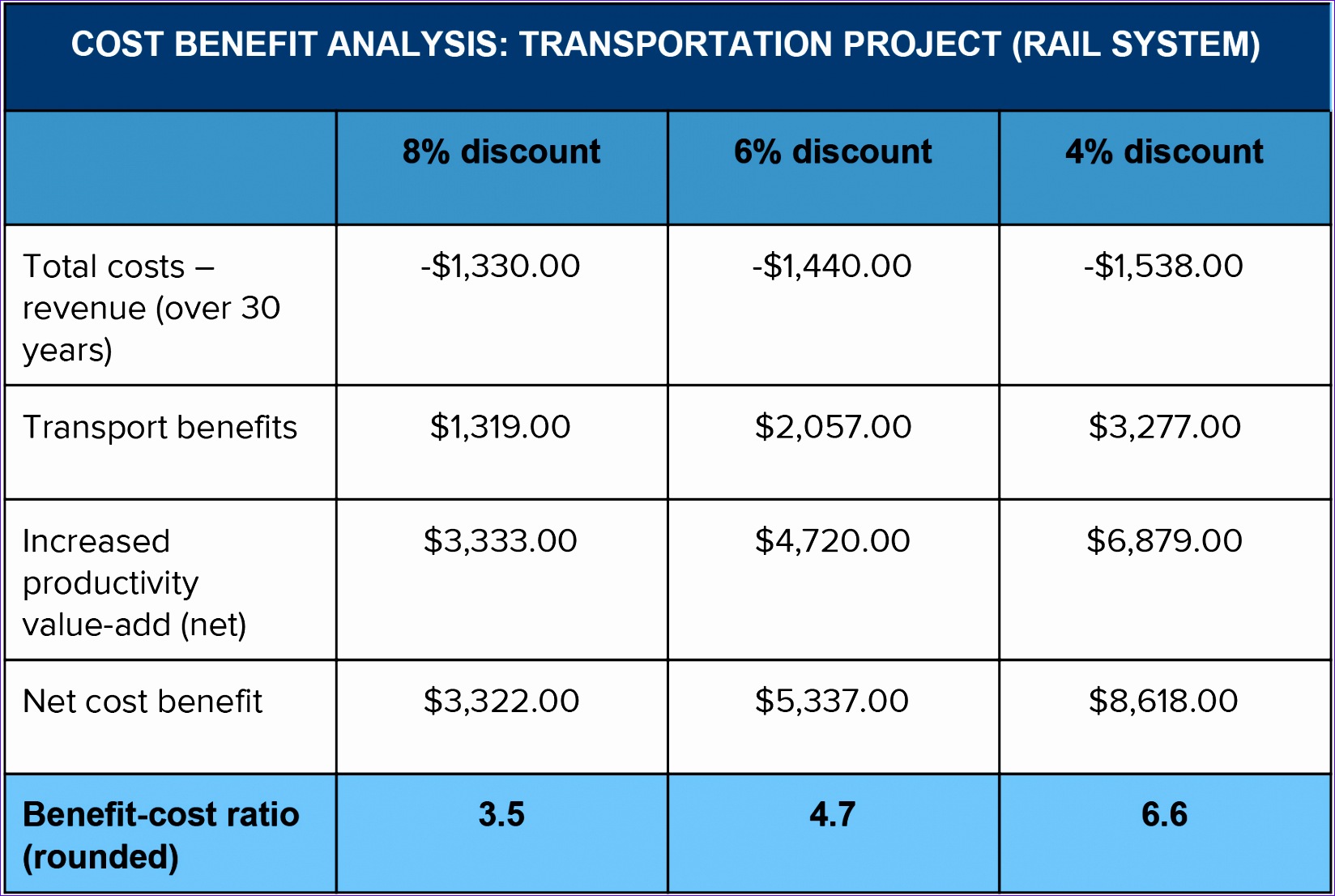

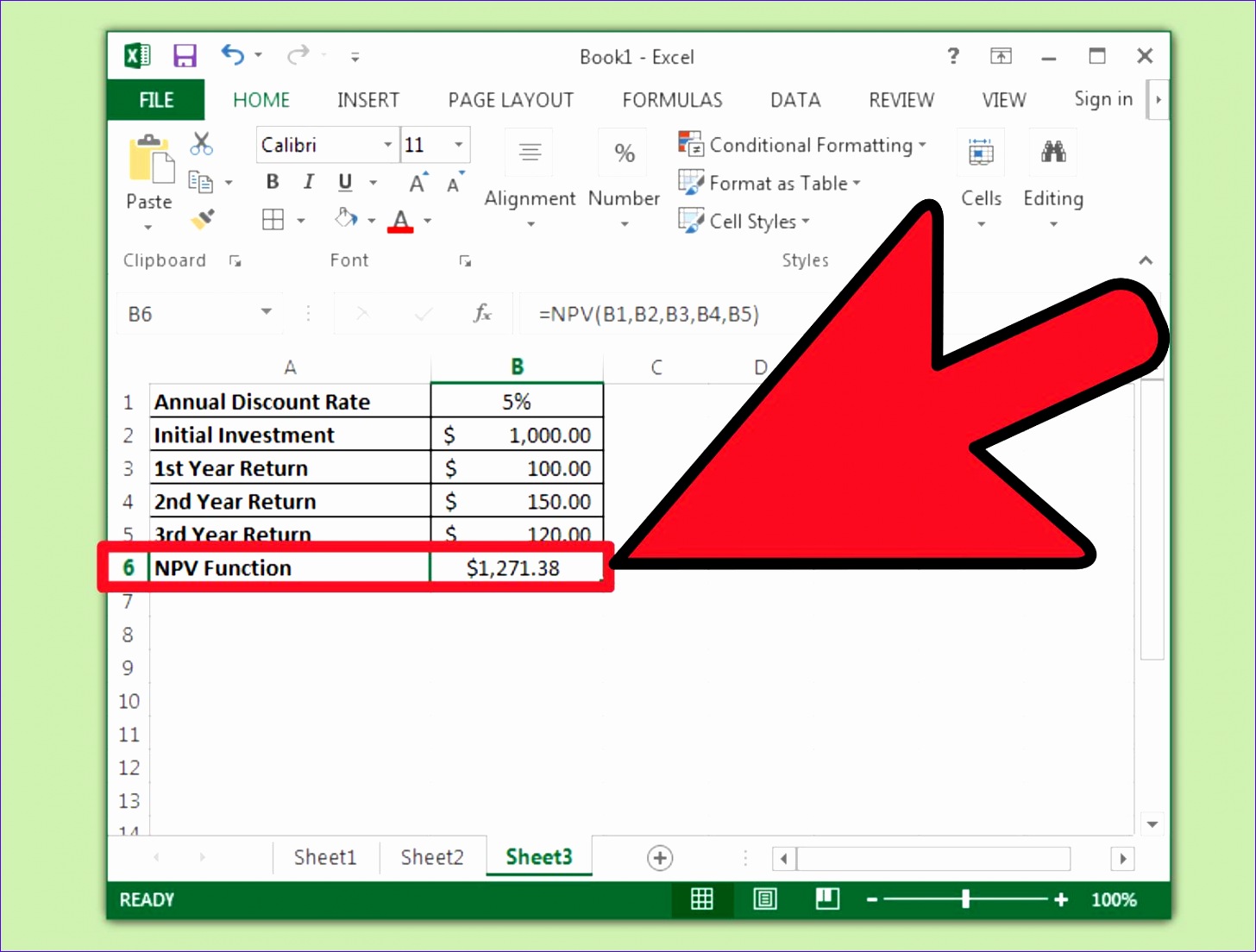

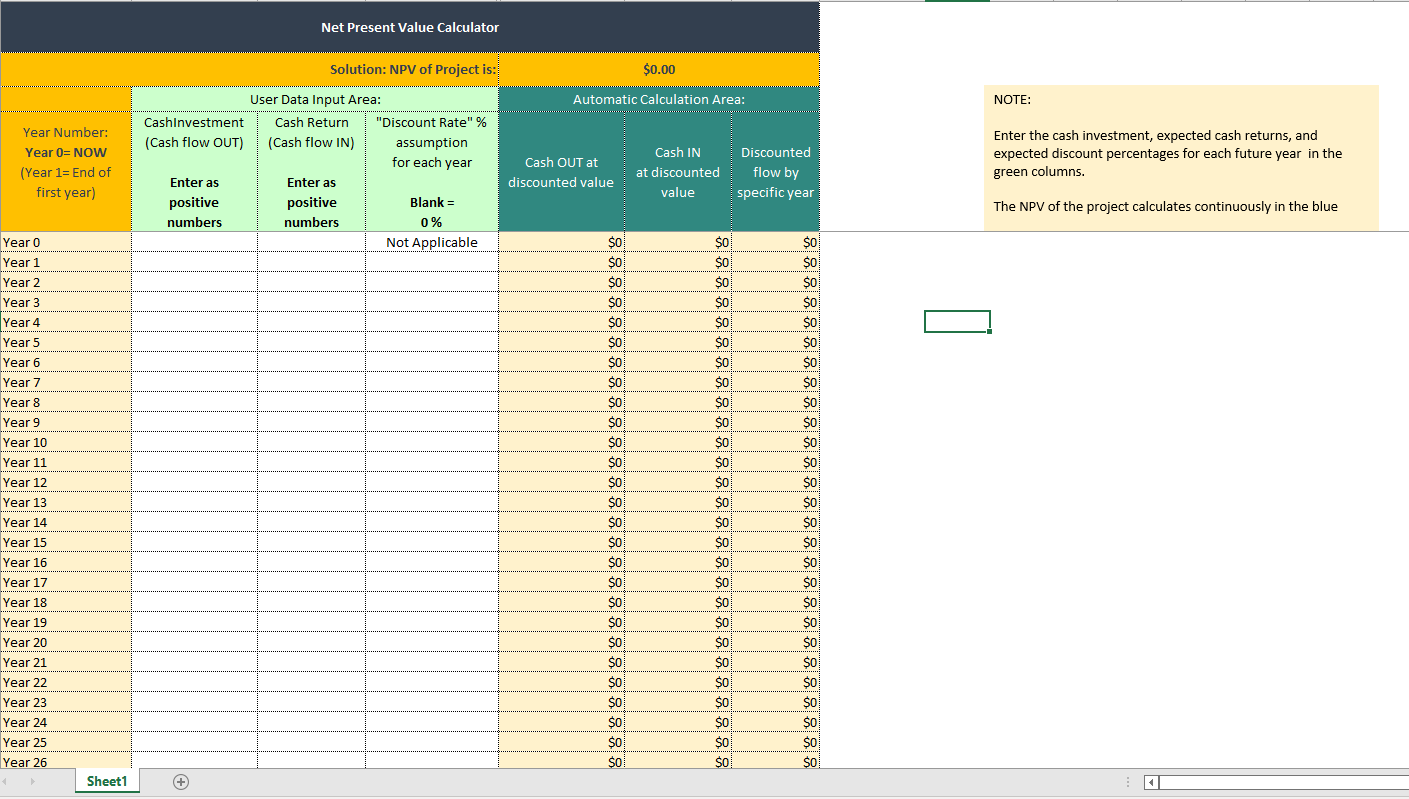

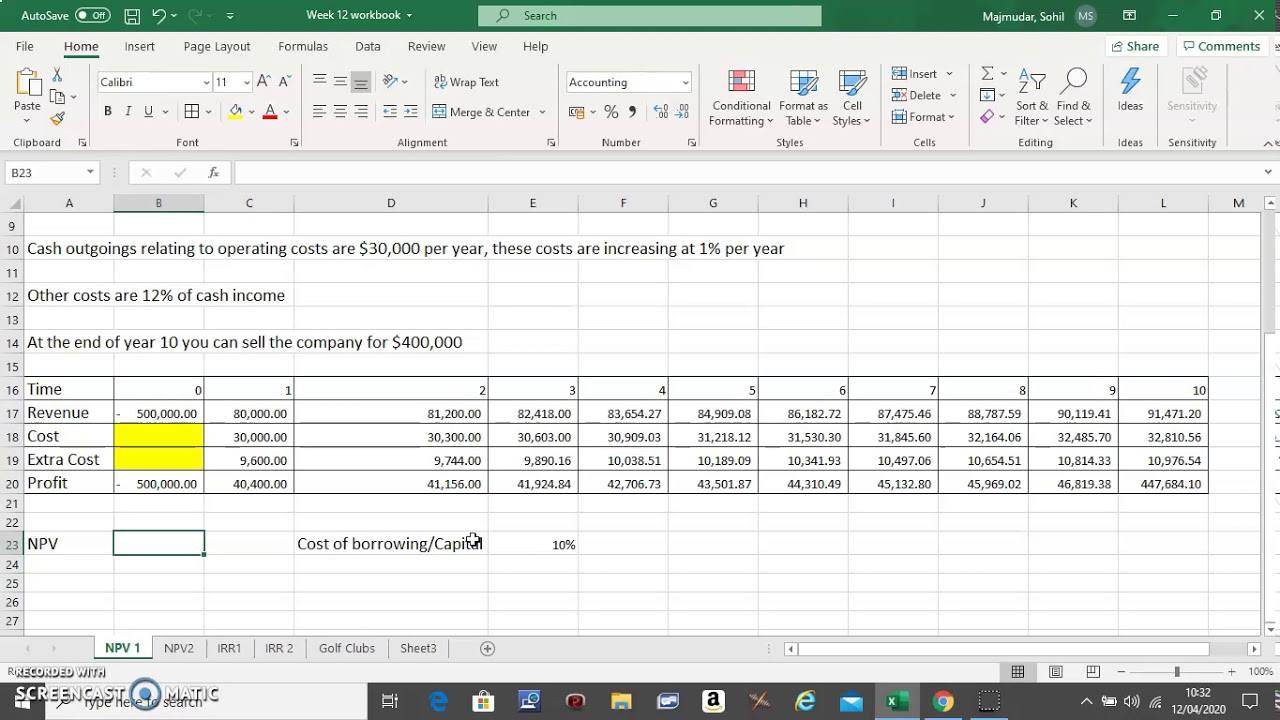

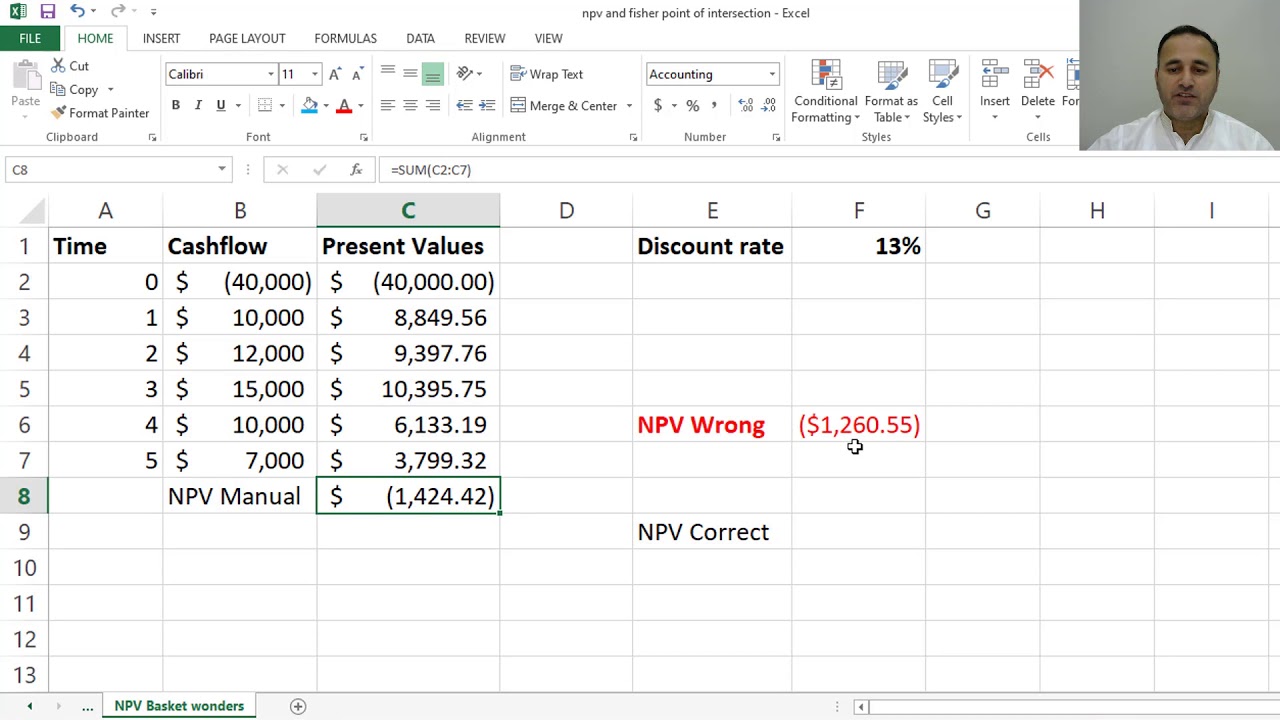

Net present value calculator excel template. This npv calculator is simple and easy to use. There is a function in excel used for the npv calculation: The use of an excel template along with a net present value calculator is absolutely necessary to determine an.

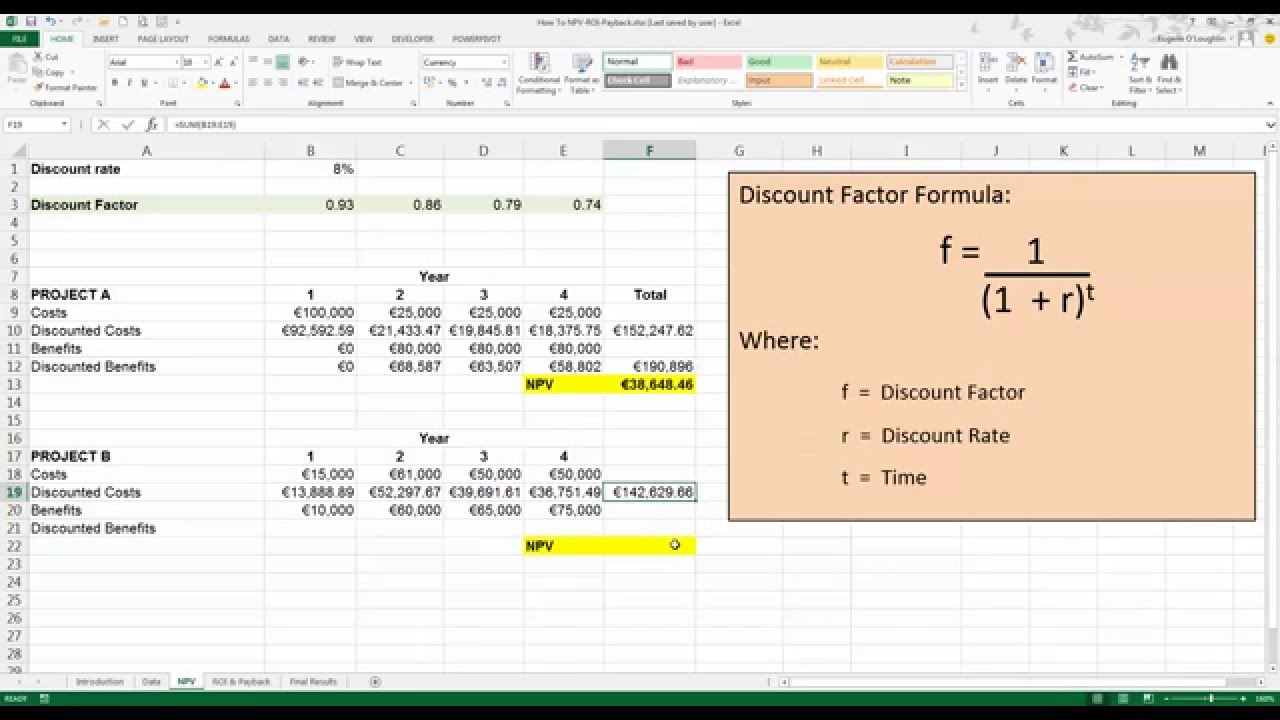

This formula is too complicated for simple math, therefore; Therefore, the formula structure was =npv (interest rate,cash flow year 1 to. The npv formula for calculating the total cash flow will be:

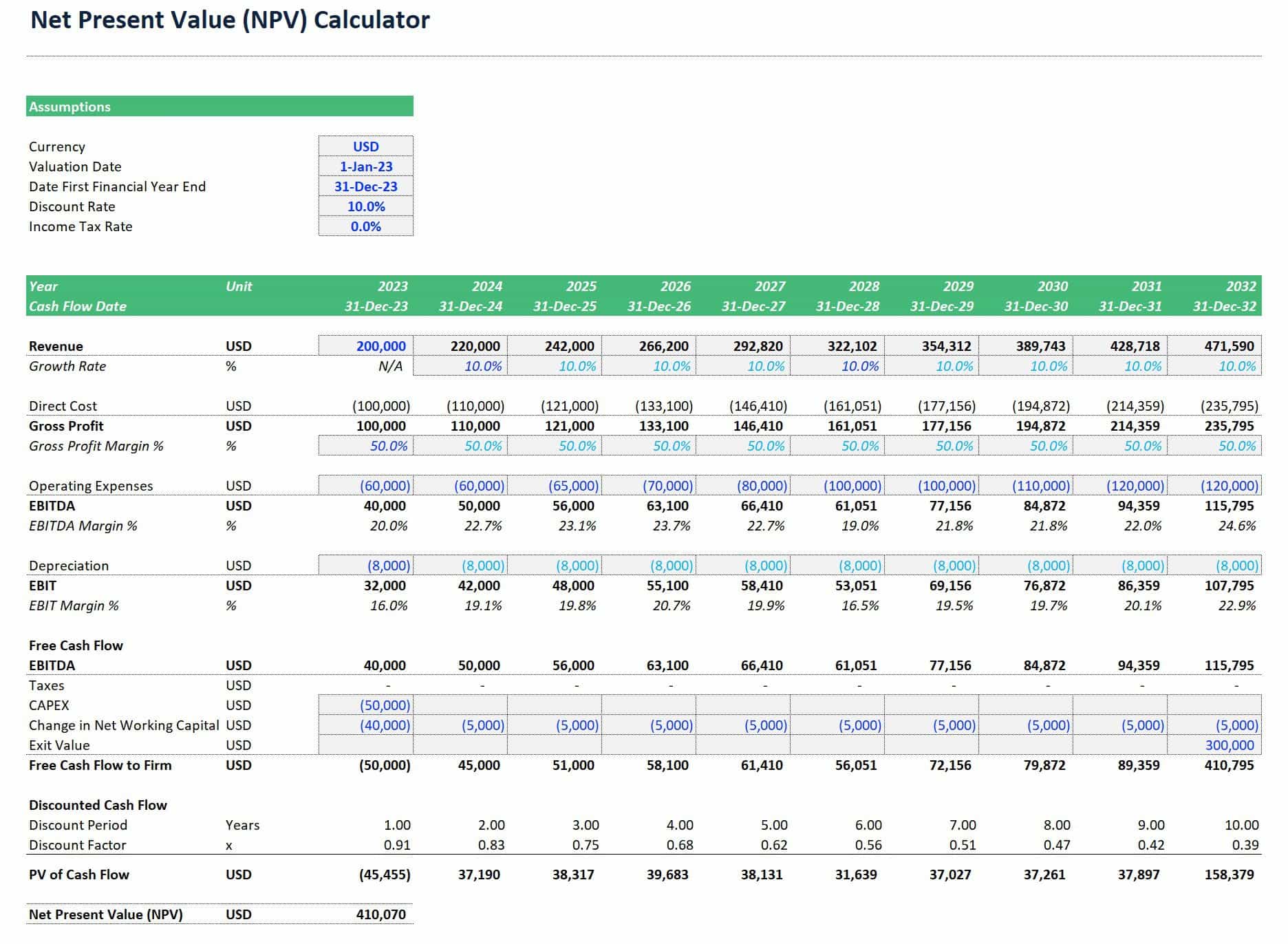

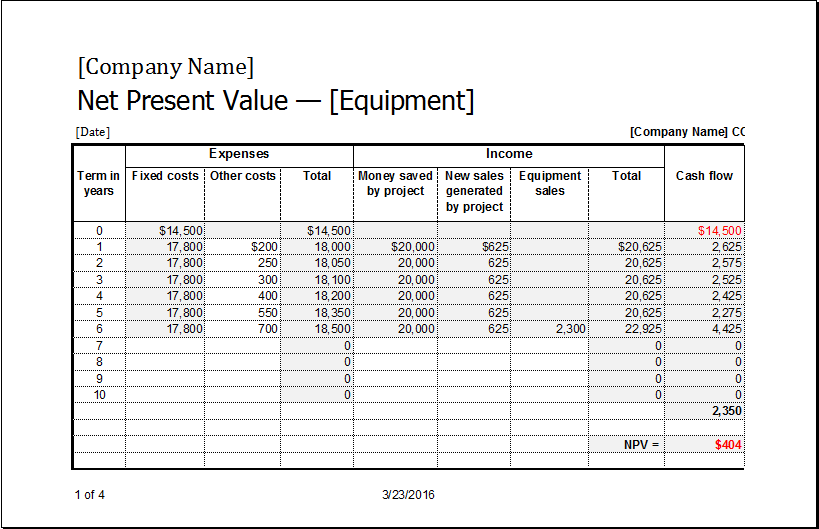

Present value can be calculated relatively quickly. Description calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). Net present value (npv) excel template helps you calculate the present value of a series of cash flows.

This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. $110/ (1+10%)^1 = $100 in other words, $100 is the present value of $110 that are expected to be received in the future. The user can easily customize the calculator in order.

Net present value template. The `xnpv` function in excel calculates the net present value for a schedule of cash flows that are not necessarily periodic. The net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and outflows.

It is used to determine the. Net present value calculator template: Fact checked by ariel courage present value (pv) is the current value of an expected future stream of cash flow.

Use this free excel template to easily calculate the. This template is an online tool that enables people to get accurate and quick results. Click here to download the npv template for more analysis on net present value, how it compares to other investment appraisal methods, and details on how the.

Download this free npv calculator from the link below. The net present value calculator excel template is very easy to use, it is also customizable to excel, and lastly it is free. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows.

The above formula gives this answer:

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)